Help Students Take Control of Their Money

MONEY ESSENTIALS OVERVIEW

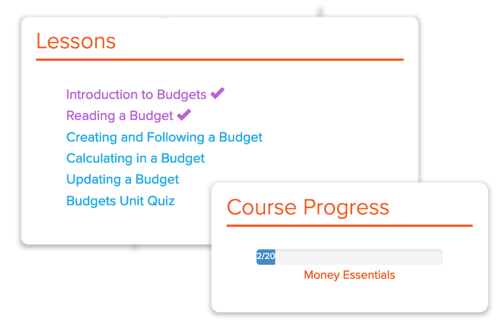

Money Essentials is an online, self-paced course that teaches students how to take control of their money and their financial situation. This course is perfect for the high school equivalency candidate, as well as adults who have their high school diploma, but may not have the skills needed to be successful at managing their money. This course contains over 20 lessons, activities, and quizzes in four units:

- Budgets

- Loans

- Financial Goals

- Credit

BUDGETS

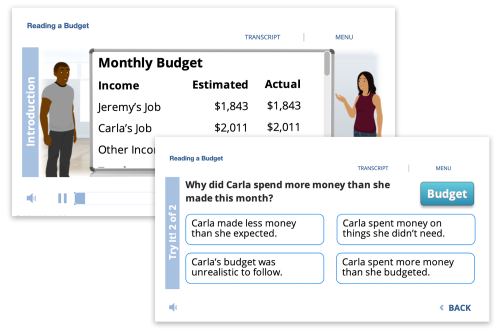

The first unit is Budgets. Being able to follow a budget is critical to money management. In this unit, students will build their own personal budget and learn how to stay on budget when temptations come along. Students will learn by watching others meet the same challenges they may be facing in their own lives. Here are the lessons covered in the Budgets unit:

- Introduction to Budgets

- Reading a Budget

- Creating and Following a Budget

- Calculating a Budget

- Updating a Budget

LOANS

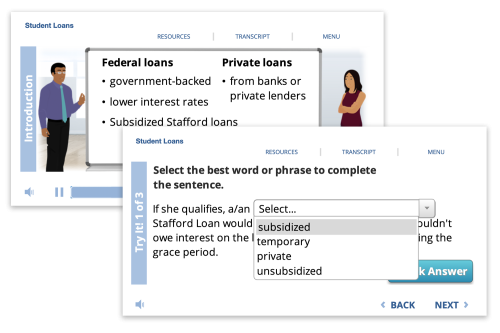

The second unit is Loans. Loans are important ways to get what we want when we want it. This unit will teach students about car loans, home loans, student loans, and how payday loan scams can destroy their credit score. Students will learn about predatory loan practices and smart money management tips. Here are the lessons included in the Loans unit:

- Introduction to Loans

- Payday Loans

- Car Loans

- Student Loans

- Home Loans

FINANCIAL GOALS

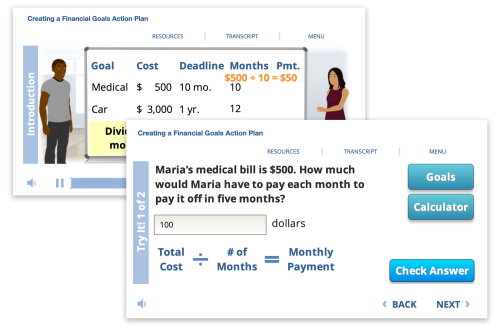

The third unit is Financial Goals. Setting realistic financial goals will help people get what they need in life. Creating goals can seem unattainable when students are barely making ends meet. This unit will teach students how to set short and long term financial goals, no matter what their financial situation may currently be. It will also teach them simple budgeting tips to be in control of their money. Here are the lessons included in the Financial Goals unit:

- Clarifying and Prioritizing Financial Goals

- Creating a Financial Goal Action Plan

- Tracking and Revising Financial Goals

CREDIT

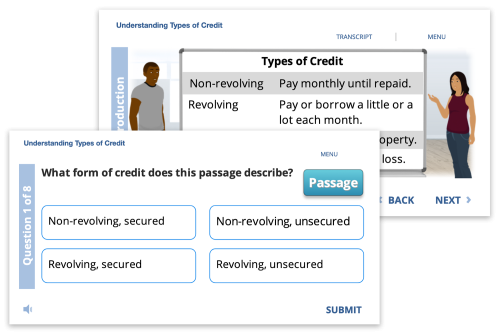

The fourth unit is Credit. Getting and using credit wisely is critical to building a secure future. This unit will teach students how to make good decisions about obtaining credit and how to avoid credit card fraud. Students will also learn how credit card scams can damage their credit standing. Here are the lessons included in the Credit unit:

- Understanding Types of Credit

- Evaluating Credit Sources

- Recognizing Signs of Predatory Lending

Get Money Essentials Today

Small Program

$26

per seat

10-49

reusable seats

Multi-Class

$23

per seat

50-124

reusable seats

Small Site

$20

per seat

125-299

reusable seats

Medium Site

$18

per seat

300-499

reusable seats

Large Site

$17

per seat

500-1999

reusable seats

Extra Large Site

$15

per seat

2000+

Order Money Essentials

Choose the number of seats to fit your class or school, then enter the exact quantity you want in the box and select "Order"

To request a quote, please complete our online Quote Request form or call 800-931-8069.

Please allow 1-2 business days to receive your quote via our online Quote Request form